A Re-Risking Phase?

Don't look now fans, but it appears that the mood of the market has changed. Gone is the fear of the next ultra-violent freak-out over this or that. Gone is the worry that the good economic times won't/can't last. And gone is the expectation that the next move lower will be "the one" that brings the bad old days of 2007-08 back. In their place appears to be nothing short of, wait for it... optimism. And a little something called re-risking.

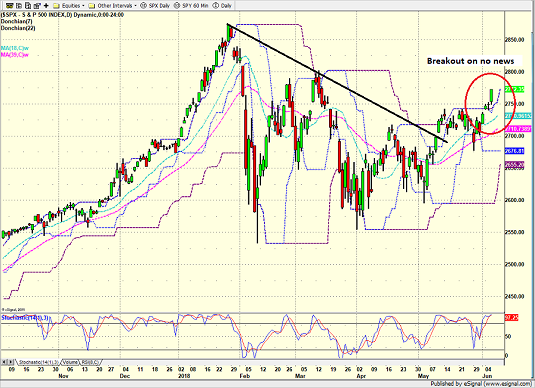

Exhibit A in my upbeat argument on this fine Thursday morning is yesterday's price action. In short, stocks put in a solid session on Wednesday without any headline, tweet, or rumor to fuel/explain the rise. The Dow enjoyed its best close since March. The S&P 500 broke out above recent resistance. And both the NASDAQ 100 and the Small-caps closed at new all-time highs. In my book this is called "good action."

S&P 500 - Daily

View Larger Image Online

It is also interesting to note that the S&P is up 7.4% from the April 1st low and has rallied approximately 5% during the so-called "sell in May" period so far. Not bad for a phase where investors fretted daily about the trade war, China, geopolitical issues, rates, Europe, the Fed, inflation, the mid-term elections, Facebook (NYSE: FB), Apple's (NASDAQ: AAPL) future, and the "retail wreck. Not bad at all.

Not Out of the Woods?

Of course, the bears will argue that the market isn't out of the woods and that the next headline that forces the algos into a tizzy could end all the good stuff in the blink of an eye. All it would take, we are told, is for the S&P to break below 2580 and it would be lights out. Pain and suffering. The start of the next bear. Ugh.

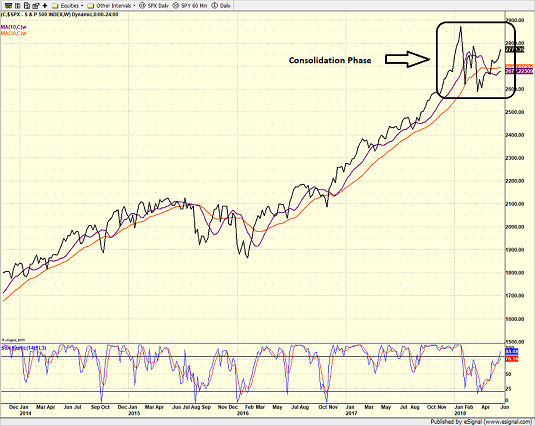

While I may be premature and/or wrong in my assessment, I've been saying for some time now that the current market action represents a corrective or consolidation phase that will ultimately be resolved to the upside.

The weekly chart of the S&P would appear to support such an argument.

S&P 500 - Weekly

View Larger Image Online

Although this theory won't be confirmed until/unless the venerable market index closes above the January high and begins to move forward, the trick to this game is to stay with the major trends in the market and to avoid getting whipsawed to death every time the fast-money traders freak out. And given that markets tend to exit a consolidation/corrective pattern heading in the same direction they were moving before the correction/consolidation began, sticking with the bulls seems to have been the right call so far.

Could I Be Wrong?

As I've opined a time or two hundred over the years, the key to long-term success in the investing game is objectivity and flexibility. So, while I am feeling pretty good about the action at the present time, I am also quick to admit that I could ultimately be proved wrong.

As such, we need to "look around" for supporting evidence to either (a) confirm the current assessment or (b) identify how I could be wrong.

While I review a big batch of indicators/models daily/weekly toward this end, a simple review of the charts can also tell the story succinctly at times.

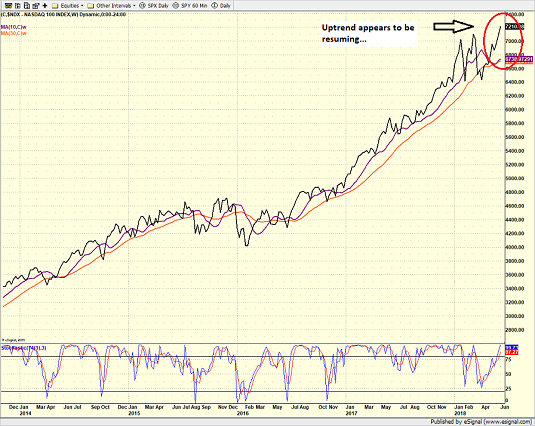

For example, take a look at the weekly chart of the NASDAQ 100 shown below.

NASDAQ 100 - Weekly

View Larger Image Online

Does, this look like the start of a bear market to you? And for the record, the period between summer 2015 and February 2016 was considered a cyclical or "mini" bear market. But instead of lower lows, the chart now sports a breakout to the upside as well as higher highs and higher lows. Good stuff.

Okay, I will admit that the last part isn't exactly clear on the chart of the NDX. So, let's keep looking.

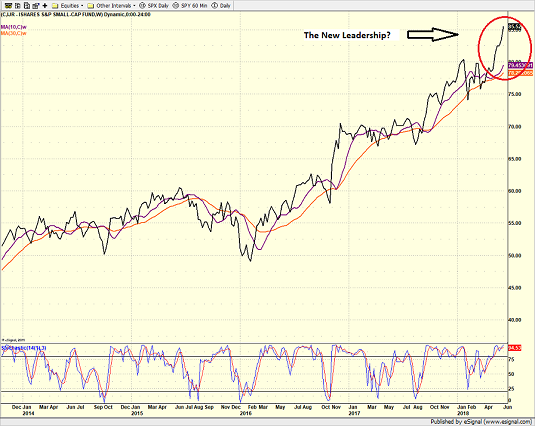

Next up is a weekly chart of the IJR - the S&P Small-Cap ETF.

iShares S&P Small Cap (IJR) - Weekly

View Larger Image Online

Here, the consolidation phase from January through April is quite clear. However, so too is the strong breakout to the upside. And while the current move could turn into a "fakeout" (anything is possible in this game!), the current move looks darn good to me.

Re-Risking?

There can be no arguing that Trump's tweet storms and the accompanying headlines over any number of topics can be a destabilizing factor to markets. And I have little doubt that stocks will again get smacked upside the head by the news flow at some point in the not too distant future. However, it looks like investors are becoming comfortable with Trump's "Art of the Deal" approach, that the forced selling from February has run its course, and that investors are now focusing on the arguably upbeat economic environment in the U.S.

In the words of Marko Kolanovic, the man often referred to as "half-man, half-market god," investors are putting risk back on in their portfolios.

"Our view is that the re-risking is likely to continue during the summer as volatility stays contained and investors increase equity positions," Kolanovic wrote Wednesday.

Marko also contends that the period of re-risking is likely to continue as "investors' exposure to equities is still relatively low... and despite the recent rally, [investors] have not meaningfully re-risked."

So there you have it; according to one of the most respected analysts on the Street these days, re-risking may be the watchword in the coming months.

To be sure, the ride is unlikely to be smooth and the moves won't be one-directional. My guess is that we will continue to experience bouts of turbulence this year as investors become reacquainted with the type of volatility that went MIA in 2017.

But, as long as the macro picture stays healthy, a period of re-risking could very well make 2018 a profitable year to have been invested in stocks. Fingers crossed!

ANNOUNCEMENT:

HCR Awarded Top Honors in 2018 NAAIM Shark Tank Portfolio Strategy Competition

Each year, NAAIM (National Association of Active Investment Managers) hosts a competition to identify the best actively managed investment strategies. In April, HCR's Dave Moenning took home first place for his flagship risk management strategy.

Want to Learn More? Contact Dave

A Word About Managing Risk in the Stock Market

Thought For The Day:

To get the full value of joy, you must have someone to divide it with. - Mark Twain

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

Must Read: What Risk Management Can and Cannot Do

HCR's Financial Advisor Services

HCR's Individual Investor Services

Questions, comments, or ideas? Contact Us

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: AAPL, FB, IJR - Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.